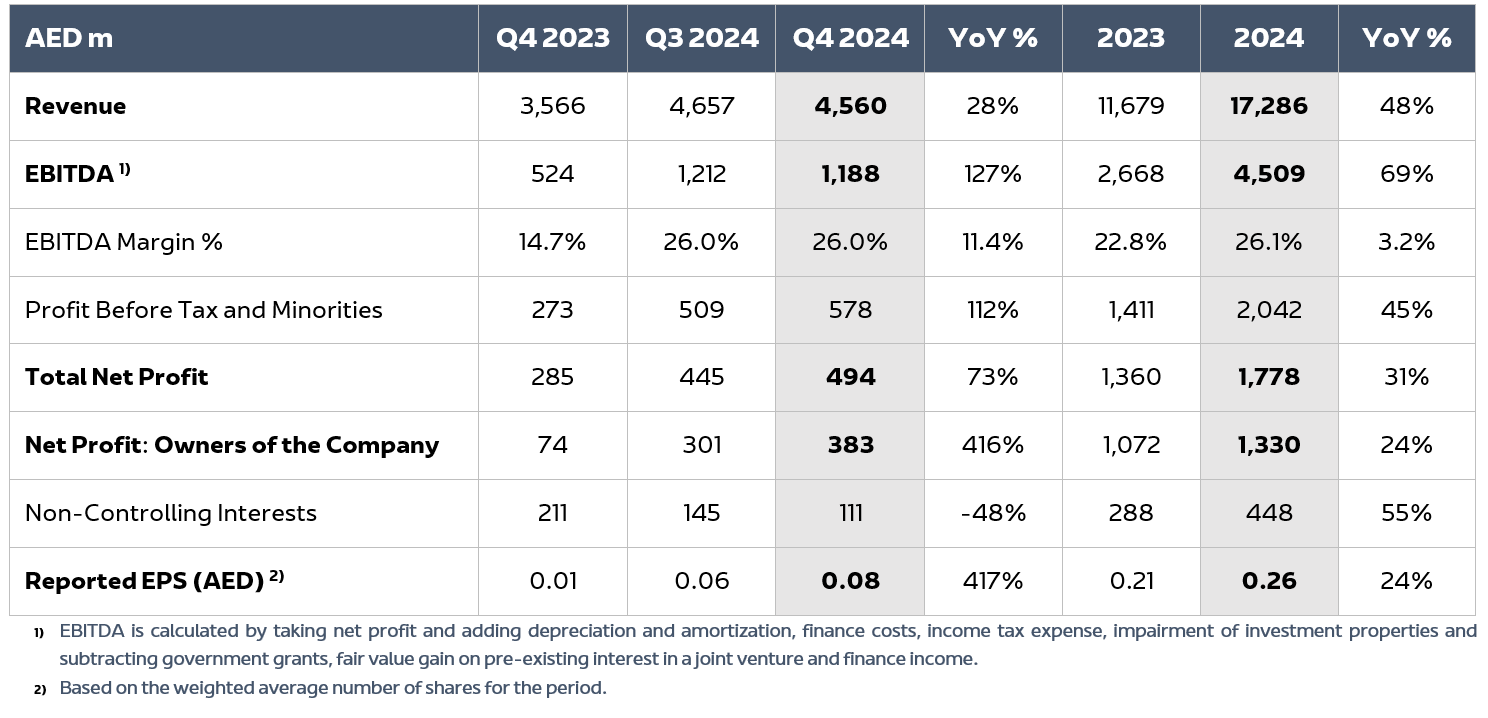

AD Ports Group Reports Another Year of Record Results in 2024 with 69% YoY Growth in EBITDA to AED 4.51 Billion and 31% YoY Growth in Total Net Profit to AED 1.78 Billion

February 14, 2025

Abu Dhabi, UAE – 14th February 2025: AD Ports Group (ADX: ADPORTS), an enabler of integrated trade, transport and logistics solutions, today announced its preliminary unaudited financial results for the fourth quarter and full year ending 31st December 2024.

The year was characterised by solid organic growth operationally and financially, fuelled by inorganic growth primarily coming from Noatum and GFS, a strengthened balance sheet with lower leverage and a stronger liquidity position, and significantly improved cash flow generation with the Group reaching positive Free Cash Flow to the Firm (FCFF) two quarters in a row in Q3 and Q4 2024.

- All five clusters reported healthy double-digit organic Revenue growth in 2024.

- EBITDA growth for the year was driven by the Maritime & Shipping, Ports, and Logistics Clusters.

- 110 bps reduction in Net Debt/EBITDA to 3.3x at the end of 2024 led by strong operating results, lower CapEx spend, and 87% cash conversion for the year.

- In Q4 2024, Total Debt dropped for the first time since listing.

- 2024 CapEx reached AED 4.1 billion, declining for the third consecutive year.

- AD Ports Group is re-balancing its capital allocation in the medium-term towards infrastructure assets in the Ports and EC&FZ Clusters.

- In 2024, there was no major acquisition announced. The focus was on securing ports assets and concessions and integrating previously announced strategic acquisitions, Noatum and GFS.

- FCFF positive on a quarterly basis for the second time in a row in Q4 2024.

Revenue increased 48% YoY to AED 17.29 billion fuelled by M&A contribution with healthy double-digit organic growth across the Group’s five business clusters ecosystem.

EBITDA recorded an impressive 69% YoY growth to AED 4.51 billion, implying an EBITDA margin of 26.1% (vs. 22.8% in 2023, +320 bps YoY). Strong operating performance was driven by the Maritime & Shipping, Ports, and Logistics Clusters.

Profit Before Tax and Minorities grew 45% YoY to AED 2.04 billion in 2024, whereas Group Total Net Profit increased 31% YoY to AED 1.78 billion, implying a Net Profit margin of 10.3%. AD Ports Group’s bottom-line performance was strong despite the introduction of corporate income tax of 9% in the UAE in 2024.

Net Profit Attributable to Owners grew 24% YoY to AED 1.33 billion led by strong operating performance.

Balance Sheet: Total Assets grew by 15% YoY to AED 63.70 billion in 2024 while Total Equity increased 15% YoY to AED 27.83 billion. Significant growth in operating profits together with plateauing debt levels led to a 110bps reduction in Net Debt/EBITDA ratio to 3.3x as of December 2024, down from 4.4x in 2023. AD Ports Group strengthened its liquidity position with a cash & equivalents balance of AED 2.83 billion at end of 2024 driven by earnings growth and an additional liquidity booster through the refinancing and upsizing of its bank facilities.

Capital Expenditures: The Group’s organic Capital Expenditures (CapEx) declined for the third consecutive year, reaching AED 4.1 billion in 2024, AED 605 million or 13% lower than in 2023.

Cash Flow Statement: AD Ports Group was Free Cash Flow positive on a quarterly basis for the second time in a row in Q4 2024 on the back of strong EBITDA growth, high cash conversion and lower capital spending. Annual Cash Flow from Operations grew almost three-fold to AED 3.91 billion in 2024, vs. AED 1.47 billion in 2023.

Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO, said:“2024 marked another year of record revenue and earnings with the Group delivering on its primary mission to enable trade. Not only did we deploy an agile, effective business strategy that translated geopolitical uncertainty in some regions into record revenue and profit, but we also leveraged the integration of our recent acquisitions to attain a new level of efficiency, international significance, and to maximise the financial synergies from the consolidation of the acquired entities. Our Group, in line with the vision of our wise leadership, grew more global and became more cohesive and profitable as we expanded our reach to more than 50 countries on five continents, while continued making large investments in our core infrastructure in Abu Dhabi, positioning it at the forefront of global trade and advancing the UAE’s economic diversification and the growth of a green, sustainable economy. AD Ports Group enters 2025 with strong momentum, despite ongoing regional macroeconomic and geopolitical disruptions, as we continue our expansion and extract further value from the synergies of our Group.”

Key Business Developments in 2024

- Completed the acquisition of 100% ownership of APM Terminals Castellon in Spain.

- Signed three 15-year cruise terminal concession agreements with the Red Sea Port Authority (RSPA) at Safaga, Hurghada, and Sharm El Sheikh ports.

- Secured a 25-year concession agreement for a Bulk and General Cargo Terminal at Karachi Port in Pakistan (KGTML).

- Acquired a 60% stake in Dubai Technologies, a trade and transportation solutions developer based in Dubai.

- Acquired 60% ownership in Tbilisi Dry Port, a key logistics facility in Georgia.

- Secured 81% ownership in the JV that signed a 20-year concession agreement to operate and upgrade the existing Luanda Multipurpose Port Terminal in Angola.

- Entered with a 30% stake in the JV with Adani Ports and East Harbour Terminals to acquire 95% of the company that operates a 30-year container terminal concession at Dar es Salaam port in Tanzania.

- Acquired 70% ownership in Safina, a provider of maritime agency and cargo services in Egypt.

- Inaugurated CMA Terminals Khalifa Port, adding a total capacity of 2.6 million TEUs, +33% to Khalifa Port’ total container capacity of 7.8 million TEUs in 2024.

- Completed the restructuring and integration of Noatum Group’s assets into AD Ports Group’s existing business verticals – Noatum Maritime, Noatum Ports and Noatum Logistics.

- Refinanced and upsized the syndicate loan amounting to a total of AED 8.2 billion into two new facilities for a total of AED 10.2 billion, while the Revolving Credit Facility was upsized from USD 1 billion to USD 2.125 billion (equivalent in AED and USD tranches) lowering spreads and extending maturities to 2026 and beyond.

- AD Ports Group’s credit rating from Fitch Ratings got upgraded to ‘AA-’ from ‘A+’ in March 2024 and Moody’s assigned an initial ‘A1’ rating with stable outlook in December 2024.

Key Business Developments in 2025

- Entered into a 51%-owned JV to develop a greenfield grain terminal at Kuryk Port in Kazakhstan.

- Started port and logistics operations at Luanda Port in Angola.

- Brought in CMA CGM Group with 49% ownership in the JV that will develop, manage and operate New East Mole multipurpose terminal at the port of Pointe Noire in the Republic of Congo, the 30-year extendable concession that AD Ports Group secured in June 2023.

Download

Thank you for your interest in our Investor downloads. You will be added to our investor database to receive updates from our investor relations teams by filling in the form.

Voyage of Discovery Application Form

Legal Disclaimer

This website contains general information about Abu Dhabi Ports PJSC (AD Ports Group) (the “Company”). The contents have been made available to you solely for information purposes and does not purport to be complete. By reading information on this website you agree to be bound as follows: nothing on this website shall constitute or deemed to constitute an invitation to invest or otherwise deal in securities in the Company.

Any investor or prospective investor considering making a transaction of securities in the Company should consult with its own counsel and advisers as to all financial, legal, tax, and related matters concerning an investment in such securities.

This website contains forward‐looking statements. These statements may include the words “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “project”, “will”, “may”, “targeting” and similar expressions as well as statements including, without limitation, those regarding the financial position, business strategy, plans, targets and objectives of the management of the Company for future operations, including development plans and objectives. Such forward‐looking statements involve known and unknown risks, uncertainties and other important factors which may affect the Company’s ability to implement and achieve results set out in such forward‐looking statements and which may cause actual results and developments to be materially different from any forecast, opinion or expectation expressed on this website.

By clicking Accept, I understand that I may be contacted by AD Ports Group and Affiliates in relation to this event and other similar events and services relevant to my industry. By registering for this event, I acknowledge that AD Ports Group and Affiliates may contact me as described herein and as otherwise set out in the Privacy Policy and in accordance with stated Terms and Conditions